Rising Sum Assured in Life Insurance: Capital Strain & Strategic Shifts

The high capital intensity of the life insurance sector necessitates substantial investments to sustain growth. The proposed FDI reforms could provide insurers with the financial flexibility to expand risk coverage and penetration.

The Indian life insurance sector is witnessing a significant surge in sum assured, driven by a strategic shift in product mix and the need to protect margins. This trend, while enhancing risk coverage, is also intensifying capital requirements for insurers.

Key Industry Trends

-

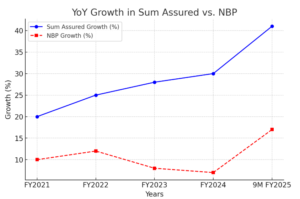

Growth in Sum Assured Outpaces Premium Growth

- Private insurers recorded a 41% YoY rise in retail sum assured in 9M FY2025, compared to 30% in FY2024.

- Retail new business premium (NBP) grew at 17% YoY, widening the gap between sum assured and premium collections.

-

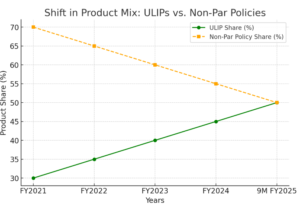

Shift from Non-Par to ULIP Products

- Increased demand for unit-linked investment plans (ULIPs), due to taxation changes and favorable equity markets, is leading to a decline in high-margin non-participating (non-par) policies.

- To counter margin pressures, insurers are increasing sum assured and rider attachments.

-

Capital Intensity & Funding Challenges

- Higher sum assured leads to higher capital intensity, requiring greater capital infusion.

- The top five private insurers now hold 65% of the retail sum assured market, up from 45% in FY2018.

- Large private insurers have raised ₹29.5 billion in sub-debt and ₹19.1 billion in equity in YTDFY2025 to meet capital needs.

Market Outlook & Strategic Implications

- The proposed 100% FDI limit for life insurance could inject fresh capital, supporting growth and bridging India’s protection gap.

- With LIC maintaining a lower average retail sum assured per policy (₹0.3 million) vs. private insurers (₹2.4 million), private players will likely continue dominating sum assured growth.

- Credit life insurance expansion is fueled by rapid growth in unsecured loans (21% CAGR in FY2021–FY2024), increasing group sum assured.